You probably heard people referring to bitcoin as a "digital gold". Apparently, this cryptocurrency has more similarities with gold than with paper money. Why is that so, and how can we choose a better investment opportunity? Let's take a look at the similarities between gold and bitcoin.

Limited Supply

We can only mine a fixed amount of gold and bitcoin. We don't know exactly how much gold is there on Earth (or in space), however with bitcoin, there are exactly 21 million coins that will be mined by 2140.

Transparency and safety

Gold has a well-established system for trading and tracking, it's hard to fake or steal it. Bitcoin is also difficult to corrupt, due to its decentralized system and complicated algorithms, but the safety system is yet to be developed.

Baseline value

Over the centuries, people used gold in jewelry production, dentistry, electronics, and much more. Bitcoin enables sending value across the globe for people with limited access to banking infrastructure. Apart from that, people can use bitcoin as a hedge aginst inflation of their paper money.

Liquidity

Both gold and bitcoin have liquid markets, which means that you can quickly convert them into cash.

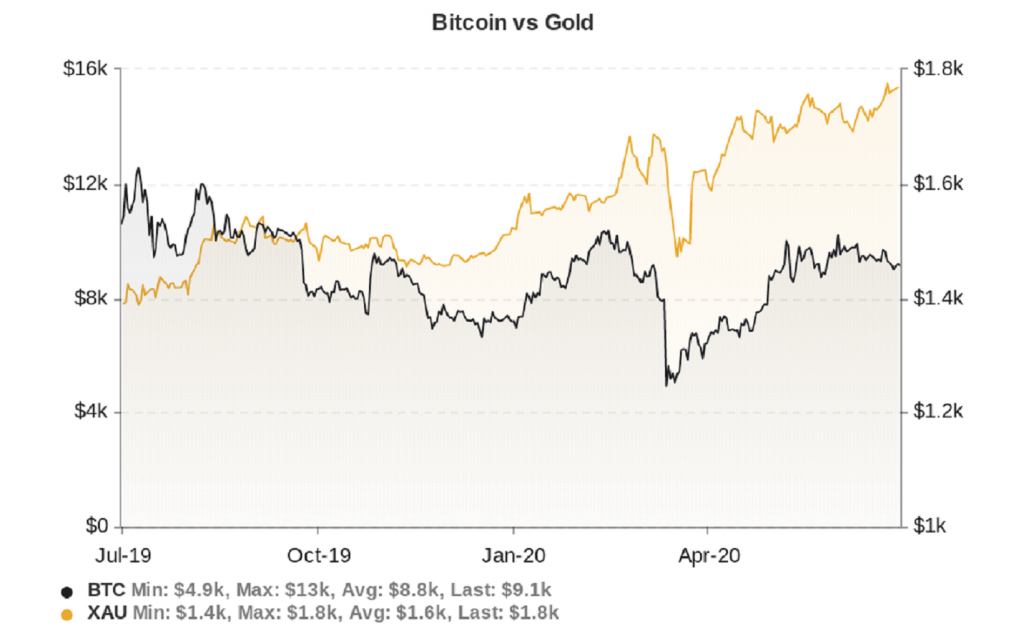

At this point you may ask - if bitcoin is so similar to gold, why don't most people use it as an investment, taking into account its higher profitability? This is where volatility kicks in. At the beginning of 2018, bitcoin reached a price of $20,000 USD, while just a year later the price collapsed to $4,000 USD and has not recovered since. The volatility is not inherent to gold, making it perhaps a safer asset.

Nevertheless, in recent years developers have been launching other cryptocurrencies that provide more stability than bitcoin. Thus investors, who see volatility as a major concern, can find more stable alternatives to bitcoin.