It's not a secret to anyone that diversification is a key to success. As an investor, you should refrain from putting all your money in one asset type. To minimize risks (in case your priority investment fails), add different assets to your portfolio, for example, gold.

Gold has been in investors' favor for many years. It tends to have low risks, mainly due to being valuable for so many years. Generally, gold has very low volatility comparing to other assets. So overall why do people choose to invest in gold?

Why gold?

The main reason for adding gold to one's investment portfolio is to hedge against inflation. Unlike fiat currency, gold is not prone to inflation. That’s why investors prefer to keep their value in gold as opposed to cash.

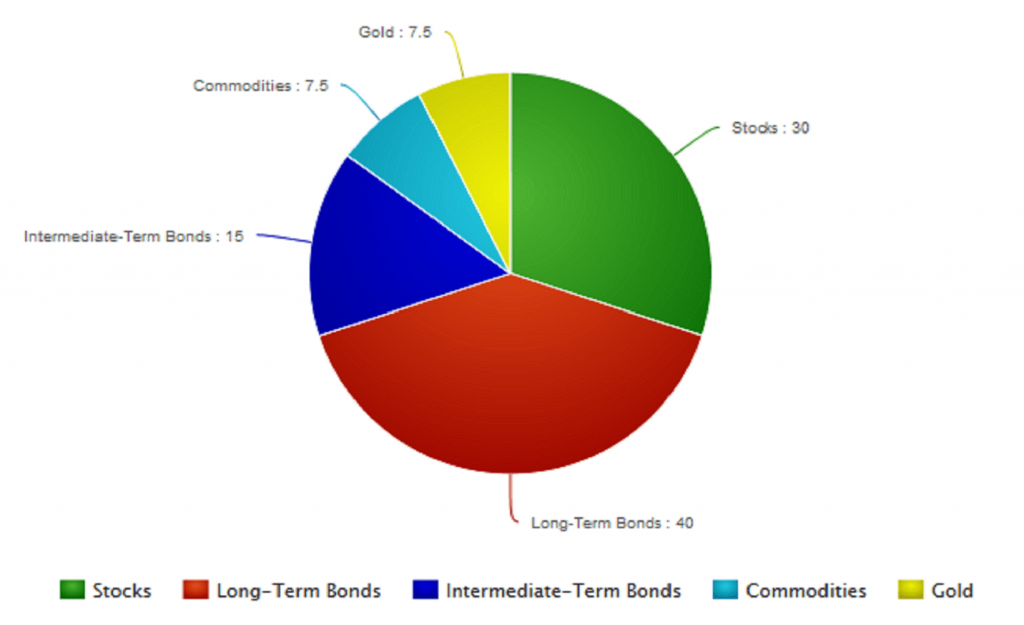

As mentioned before, portfolio diversification plays important role in minimizing one's risks. Gold is a perfect investment instrument for this matter. The majority of investors hold their value in stocks and bonds, but for better diversity, they will add some gold as well.

How much gold should you invest in?

The proportion of gold in your portfolio is very personal, as different people have different risk levels. If you prefer to keep your portfolio at very low risk, you will add more gold, if you're willing to risk for the opportunity to get higher returns, the gold percentage in your total assets will be smaller. The rule of thumb is to limit gold to around 5-10% of your overall investments.

Implications

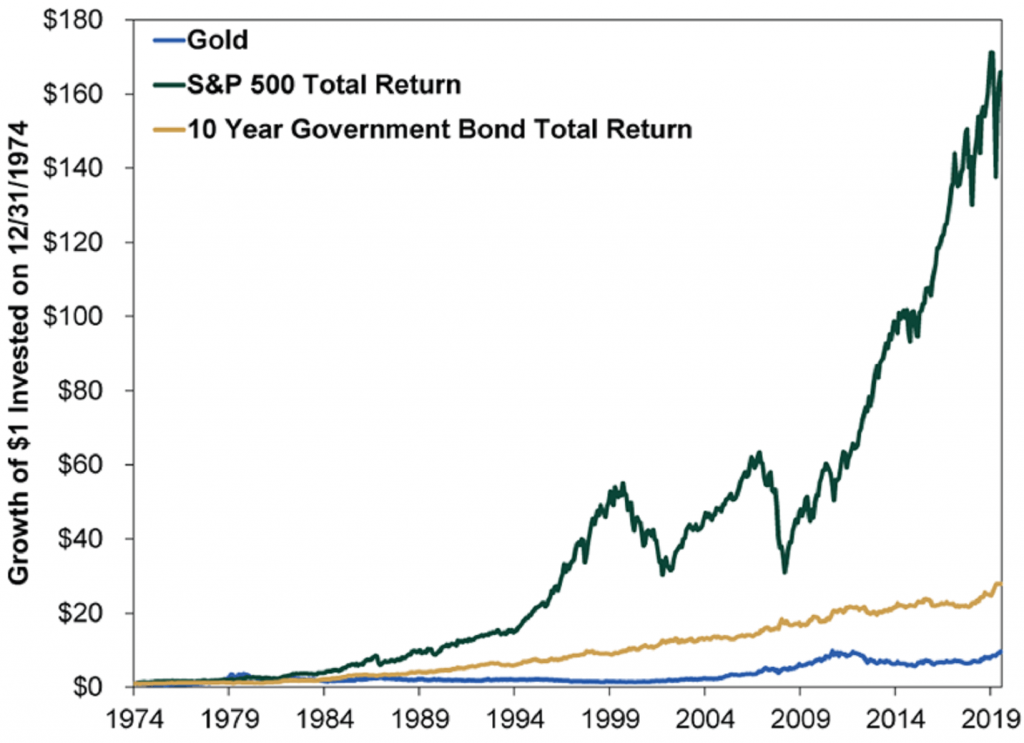

As we can see, gold has a very low-risk level. But why don't all investors keep their money in gold, knowing that the price will always grow? Yes, it will, but at what pace? Low risks always imply low returns. If you are willing to take your chances to make a 10% profit in one day from your investments, you will never choose gold.

In the end, you should always aim to reach your financial strategies. If gold helps you to obtain your goals, you should definitely own some.