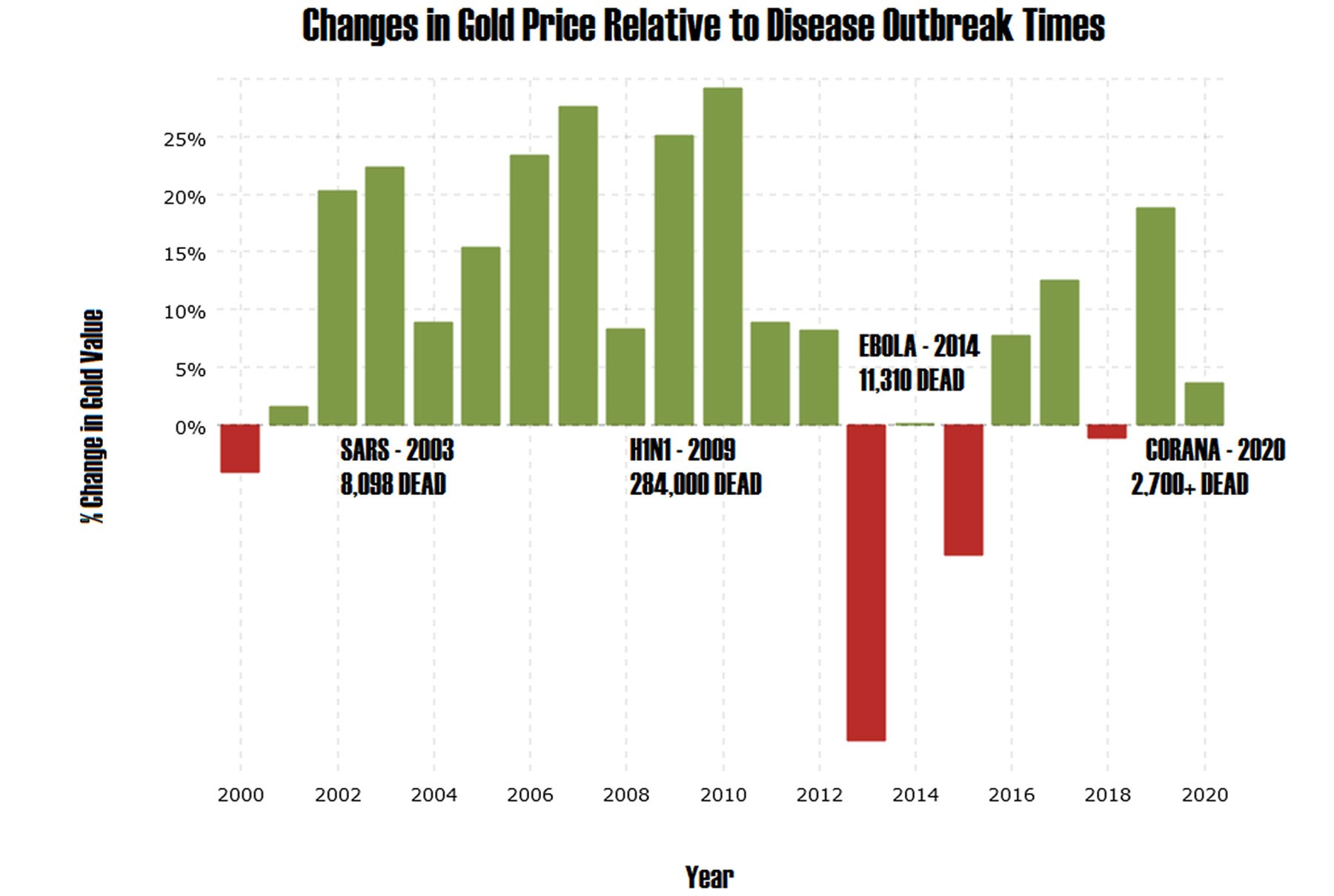

The threat of a Coronavirus epidemic impacts more than simply our health; the potential outbreak has led to global economic uncertainty and has put markets in disarray. For example, the prices of oil and other commodities have taken a sharp plunge. Oil prices themselves have dropped 20% from the record high price in the middle of January among the Iran news, and other metals followed suit. However, gold is the only commodity that has risen in price, hitting a 3-week peak.

There is a clear positive impact that epidemics have on the value gold, where the price rises during epidemics. This can be seen during recent pandemic outbreaks, showing that the market always views gold positively and as a safe option during volatile times. In fact, the worse the situation got, the higher that gold was valued in the markets. So amidst all this chaos and fear surrounding the Corona epidemic, there is a silver lining (or gold lining), for potential sellers as this is potentially the most profitable time to sell their gold.