2020 has brought many changes that we've seen affect gold prices. While they were mostly positive changes, recently we've seen gold prices drop. As Covid-19 affected employment and the government acted to combat it, gold prices rose to record highs! But with the recent news of a vaccine, gold prices saw a drop and are now hovering below $1890.00 USD. So what do we have to look forward to in 2021?

While we've seen vaccines with a reported 90% effectiveness, and recently one with 94.5%, it's clear that we're seeing progress towards a cure. But the progress is slow, and there's still lots we don't know. Long term effects have to be tested for, and we've yet to see a 100% effectiveness rate. In the meanwhile, the number of new Covid-19 cases is likely to continue to spike.

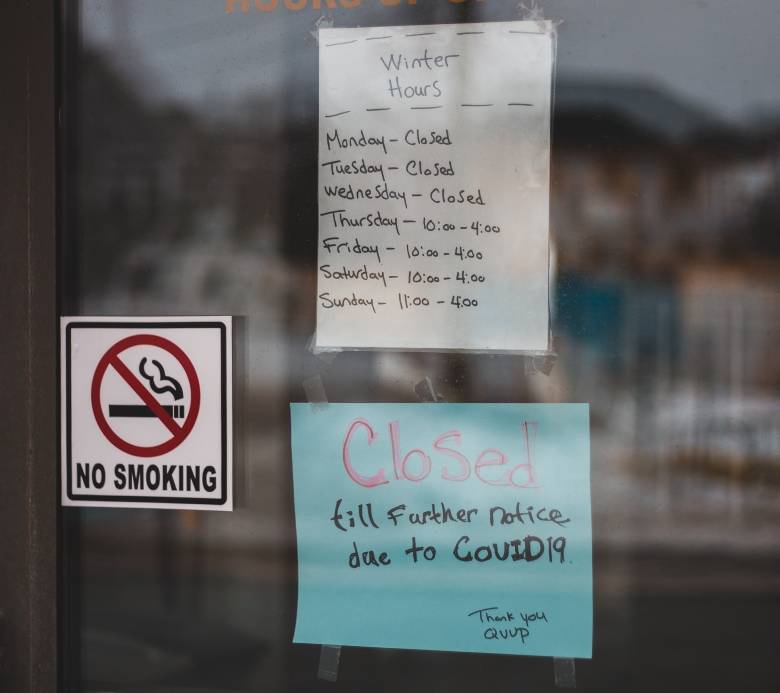

New Restrictions

As the governments struggle to reduce the number of deaths and the spread of the virus, they set up new regulations. Many restrictions placed on the businesses limit & negatively affect their business. As the number of cases in an area grows, so do the restrictions on that area. The number of people allowed in an area may be reduced. Or some non-essentials may be closed entirely. As restrictions increase, businesses will suffer. This, in turn, will have a negative impact on the economy, which will also benefit gold prices.

Lockdown

If these restrictions don't work, and cases rise, the priority is hospitals. If it appears that they will become overpopulated, it's likely that we'll see another lockdown. During this time, businesses will be closed or have to operate on a much smaller scale. Employees will be off work. And people will go out less & spend less. All of this is good for gold which will see strong growth in this event.

Stimulus Relief

During these times, especially during a lockdown, many people and businesses will be without funds. At this time, it's extremely likely that the government begin to issue a stimulus to help the economy and its people. While Biden has stated that he will already do so without a lockdown following his election, However, the inauguration date is set to January 20, 2021, and much can change between now and then.

And while there are many uncertainties that lie ahead, 2021 is looking good for gold. Right now gold has bounced back following the poor economic news from the New York Federal Reserve. The Empire State manufacturing survey’s general business conditions index dropped to 6.3 in November from 10.5 in October. While forecasts were calling for an increase to 13.8, this helped to combat the news of yet another vaccine out. While gold is likely to rise in 2021, the coming months may see more bad news which will affect gold prices. And now is likely the best time to sell until mid-2021.